Bottom Line: Machine learning improves the Request for Proposal (RFP) process by replacing silos with real-time data & insights, all essential for creating the industry's first Benefits Placement System that acts as a trading exchange between carriers and brokers.

Manually-Processed RFPs Waste Too Much Time

An employer's benefits are a powerful differentiator when it comes to attracting and retaining the best talent in a given industry, especially in competitive industries like DevOps and tech. There are many challenges to buying, selling and managing insurance. Antiquated, manual processes for managing RFPs drain valuable time out of serving employers with more competitive benefits.

Seeing an opportunity to improve the RFP process using data, advanced predictive analytics and machine learning, ThreeFlow focused on the greatest pain points the employee benefits industry has today. Founders Richard Perrott, Ryan Sachtjen and Shaheeb Roshan resolved to improve the RFP process and create the industry's first Benefits Placement System, which acts as a real-time exchange between employee benefits insurance carriers and benefits insurance brokers. Ryan Sachtjen had spent 12 years at Sun Life Financial selling employee benefits. During that time, he began to see how the RFP process could be made much more efficient with the right tools to collaborate with broker partners. "Everything was in its silo: separate spreadsheets, separate tools, separate systems. It limited our ability to develop the deep collaboration that could drive value for our employer clients and, more importantly, us," Ryan said.

ThreeFlow's founders said that brokers were not as productive as they could be without an automated RFP process and platform for achieving more collaboration. They discovered a $150B productivity gap in how employee benefits insurance is placed every year in the mid-to-large market, largely due to antiquated, manual processes and siloed systems that lack the data brokers need to close sales. As the company has grown, ThreeFlow closed on their Series A funding round today for $8 million with Emergence Capital with Equal Ventures and First Trust Capital Partners' participation.

How Machine Learning Is Improving the RFP Process

Getting RFPs right and managing them in real-time by applying predictive insights into how carriers and brokers can work together is a core focus of ThreeFlow today. Providing carriers with an application that gives them the freedom to highlight their best differentiators while serving more potential prospects in less time is one of the key design goals of the company’s Benefit Placement System platform. At the same time, brokers use the system to gather and track the information they need on carriers of interest to compare multiple bids at once.

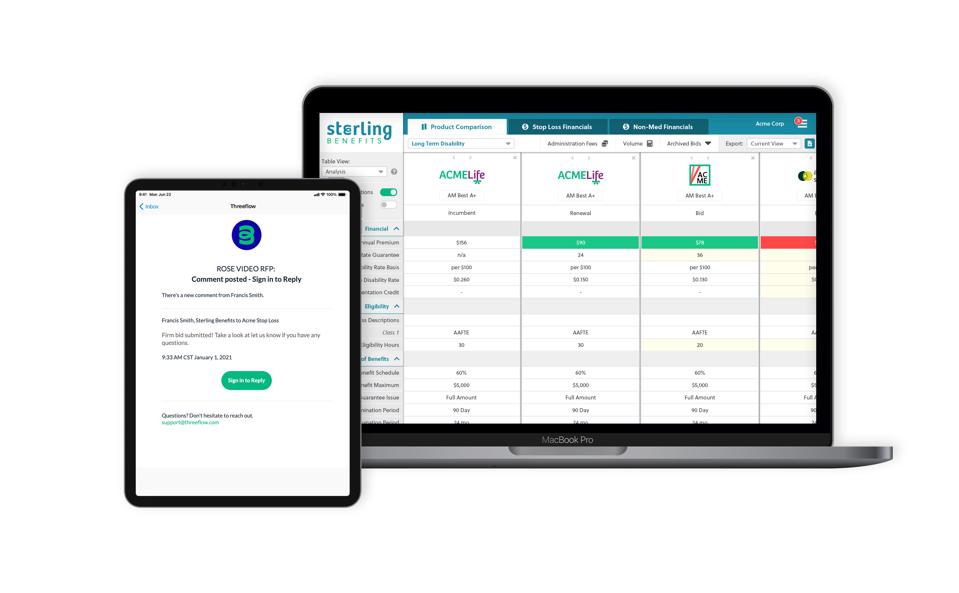

What makes the ThreeFlow Benefits Placement System unique is how adaptive it is to a given carrier and broker's unique needs. "Employer groups with over 50 employees tend to have hyper-customized insurance programs and often require customized products. Every plan is its snowflake," Ryan said during a recent interview. Capturing RFP, transaction, sales history and service data then analyzing it using predictive analytics and machine learning algorithms have the potential to provide new insights into how business transactions over time can be improved. The following is an example of how brokers can compare quotes on a single screen from multiple carriers:

ThreeFlow.com

How ThreeFlow Is Achieving A Network Effect

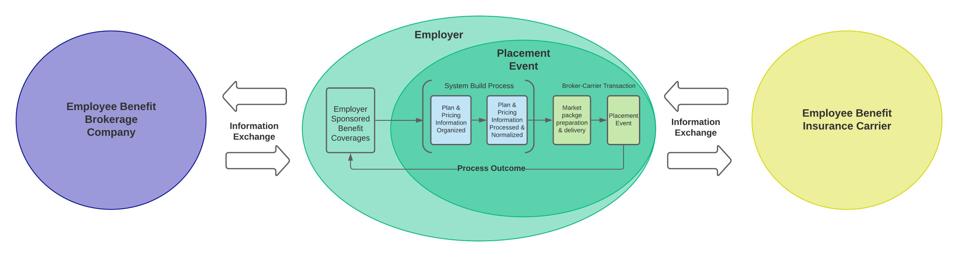

Bringing together carriers and brokers on a unified Benefits Placement System and automating the RFP process so they can collaborate in real-time creates the perfect conditions for network effects to flourish. One of the most exciting aspects of ThreeFlow's business model is how they are using data to produce predictive analytics and machine learning-based insights to accelerate a network effect across brokers and carriers. The following is a diagram that explains how ThreeFlow automates the RFP process, with a specific focus on the Broker – Carrier transactions. The process workflow shown below provides personalization at scale for every carrier and broker who enrolls in the Benefits Placement System, with each adding more value to the entire network.

ThreeFlow.com

Co-founder Ryan Sachtjen says the network effects of the Benefit Placement System platform have broadened the company's geographic footprint and, with it, new opportunities have been created. ThreeFlow sees a 40% increase in new broker introductions being generated by way of carrier introductions – a sure sign of a network effect adding value to members of their platform. "Carriers want the largest demand-side that they can possibly get and the brokers want the same on the carrier side. We see it being a complementary relationship in that and in each additional participant, whether it be on the broker side of a broker partnership or the carrier side leads to greater value in terms of our system in and of itself," Ryan said.

Conclusion

Choosing the take on the challenge of streamlining RFPs in benefits insurance while capturing transaction, customer and service data creates ideal conditions for a network effect across carriers and suppliers. Mining the data and providing new predictive insights and algorithmic-based scenarios will open up an entirely new line of services for ThreeFlow, making this startup a noteworthy one to watch in the financial services and insurance industry.

"machine" - Google News

January 15, 2021 at 03:32AM

https://ift.tt/3oKoeP1

How Startup ThreeFlow Is Transforming How Benefits Are Sold Using Machine Learning - Forbes

"machine" - Google News

https://ift.tt/2VUJ7uS

https://ift.tt/2SvsFPt

Bagikan Berita Ini

0 Response to "How Startup ThreeFlow Is Transforming How Benefits Are Sold Using Machine Learning - Forbes"

Post a Comment