Consumer groups analyzing insurers’ underwriting performance from 2020 have concluded that auto insurers reaped billions of dollars in excess profits due to reduced accidents during the lockdowns, and say consumers are still owed billions in additional refunds.

“Insurers selling personal auto insurance reaped windfall profits of at least $29 billion in 2020 as miles driven, vehicle crashes and auto insurance claims dropped because of the pandemic and related government actions,” according to the Consumer Federation of America (CFA) and Center for Economic Justice (CEJ).

The groups’ analysis show that insurers collected $42 billion in excess premiums while refunding only $13 billion in “premium relief” payments to consumers.

“Instead of returning the COVID windfall to consumers, insurers increased payouts to senior management and stockholders,” the CFA and CEJ said.

“In virtually every state, auto insurance premiums – by law – cannot be excessive,” said J. Robert Hunter, CFA’s director of insurance. “The inability or unwillingness of almost all state insurance regulators to enforce the law and protect consumers raises serious questions. As we pointed out in letter after letter to insurance regulators throughout 2020, it was crystal clear that insurers’ premium relief was woefully inadequate.”

A review of insurers’ financial reports by CFA and CEJ showed that between 2016 and 2019, auto insurers paid 67.4 cents in claims for every premium dollar collected (known as loss ratio). In 2020, the insurers’ loss ratio dropped to 56.1 cents per dollar of premium, or $33.6 billion less than if their loss ratio had remained at 67.4 as in prior years.

The consumer groups say that the $33.6 billion reduction in claims translates into $42.1 billion of excess premium charges out of a total of about $258.6 billion in total personal auto insurance premium. Yet, according to A.M. Best, insurers returned just $13 billion in premium relief, or less than one-third of their pandemic windfall, while pocketing the remaining two-thirds.

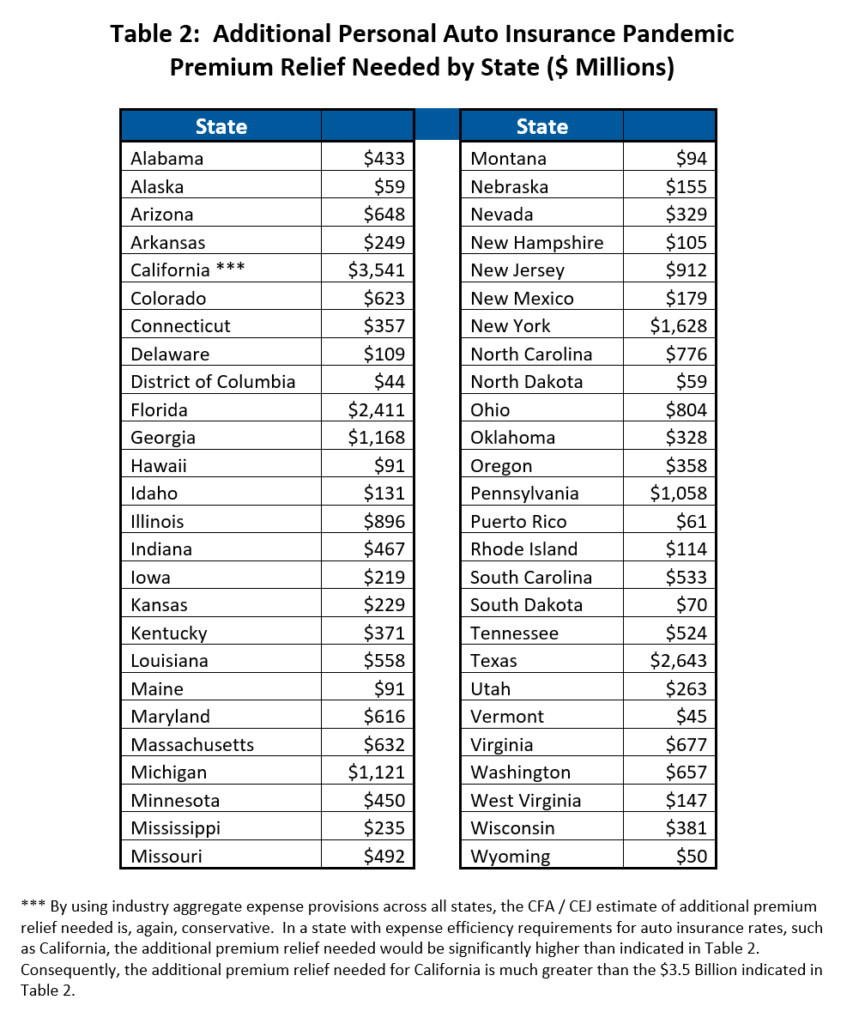

The consumer organizations calculated what they say is a “conservative estimate” of what each state’s drivers are still owed in terms of premium refunds. Large states like California, Florida and Texas are owed more than $2 billion each, according to the analysis.

Additional personal auto insurance pandemic premium relief needed by state as provided by the Consumer Federation of America and Center for Economic Justice.

A separate analysis conducted by the non-profit consumer group Consumer Watchdog found that insurers earned excess profits of about $5.5 billion in California alone.

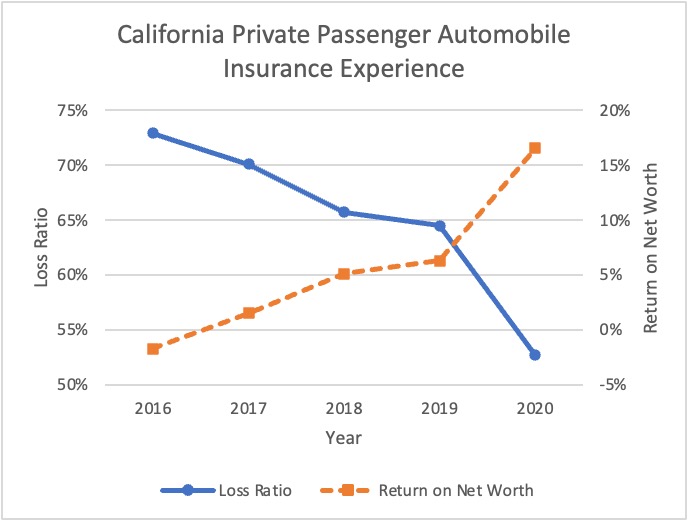

“Newly published 2020 data show that accident claims plummeted as cars idled in driveways, but insurance companies failed to reduce rates accordingly,” the group said in a statement. “As a result, insurance companies’ average return on net worth – a measure of profitability that includes premiums and investment income – was more than twice what California law allows last year.”

According to the consumer group, the lower that insurance companies’ loss ratios go – the more of each premium dollar they keep for themselves (as they did with 2020’s 52.7% loss ratio) – the higher companies’ return on net worth climbs.

A separate analysis conducted by the non-profit consumer group Consumer Watchdog found that insurers earned excess profits of about $5.5 billion in California alone.

“Newly published 2020 data show that accident claims plummeted as cars idled in driveways, but insurance companies failed to reduce rates accordingly,” the group said in a statement. “As a result, insurance companies’ average return on net worth – a measure of profitability that includes premiums and investment income – was more than twice what California law allows last year.”

According to the consumer group, the lower that insurance companies’ loss ratios go – the more of each premium dollar they keep for themselves (as they did with 2020’s 52.7% loss ratio) – the higher companies’ return on net worth climbs.

Consumer Watchdog is calling on California Insurance Commissioner Ricardo Lara directly to order the insurers to return what is owed to California consumers.

The relationship between loss-ratio and return on net-worth for an insurance company. Chart provided by Consumer Watchdog.

While the commissioner has issued four bulletins directing insurance companies to refund overcharges, the Department of Insurance allowed insurers to calculate for themselves what they owe. The top 15 auto insurance companies, representing 70 percent of the market, have subsequently repaid approximately $1.9 billion for 2020, “less than half of what they overcharged California consumers,” Consumer Watchdog says.

“Asking insurers to calculate their own refunds hasn’t resulted in consumers getting what they’re owed,” Carmen Balber, executive director of Consumer Watchdog, said. “Insurance companies are hanging on to billions of drivers’ dollars that should be helping Californians get back on their feet as we emerge from the pandemic. The Insurance Commissioner must require companies to refund past overcharges in full, with interest, and make sure rates are not excessive going forward.”

While data on 2021 overcharges is not yet available, the consumer group says that the pandemic has continued to affect traffic patterns, and accident rates are still not what they were before March of 2020, indicating that insurance companies owe consumers billions of additional refunds for the first six months of 2021.

The American Property Casualty Insurance Association (APCIA) was quick to criticize the analysis of the consumer groups, calling it “misinformation.”

“CFA and CEJ are wrong on just about everything in their latest report,” said David Snyder, APCIA vice president, international and counsel. “The fact is that insurer profits are less than 2 percent of each auto insurance premium dollar. The vast majority of what they call profit are expenses used to handle claims, sell and service policies and pay taxes and regulatory fees.”

According to Snyder, while there was an “initial drop in driving at the onset of the pandemic” miles driven have “returned to pre-pandemic levels.” Snyder also pointed out that accident severity has increased since 2019 and there has been a significant jump in fatalities.

“Had unjustified premium cuts been ordered last year, it would simply have put additional upward pressure on rates this year because of the rapid increases in miles driven and the greater rate of crashes and losses,” Snyder said.

More information:

Auto Insurers Reaped Nearly $30 Billion Pandemic Windfall Profit in 2020 as State Insurance Regulators Fail to Protect Consumers

https://consumerfed.org/press_release/auto-insurers-reaped-nearly-30-billion-pandemic-windfall-profit-in-2020-as-state-insurance-regulators-fail-to-protect-consumers/

Auto Insurance Companies Overcharged California Motorists $5.5 Billion During the First Year of Pandemic, Study Shows

https://www.consumerwatchdog.org/insurance/auto-insurance-companies-overcharged-california-motorists-55-billion-during-first-year

Setting the Record Straight on CFA’s Latest Misinformation

https://www.apci.org/media/news-releases/release/68014/

Featured image: iStock (RichVintage)

Additional personal auto insurance pandemic premium relief needed by state as provided by the Consumer Federation of America and Center for Economic Justice.

The relationship between loss-ratio and return on net-worth for an insurance company. Chart provided by Consumer Watchdog.

Share This:

Related

"auto" - Google News

September 06, 2021 at 09:00PM

https://ift.tt/2VmryXa

Auto insurers scored windfall profits from pandemic lockdowns - Repairer Driven News

"auto" - Google News

https://ift.tt/2Xb9Q5a

https://ift.tt/2SvsFPt

Bagikan Berita Ini

0 Response to "Auto insurers scored windfall profits from pandemic lockdowns - Repairer Driven News"

Post a Comment