From the November 2021 issue of Car and Driver.

Dennis Groom, a stay-at-home dad from Dexter, Michigan, thought he could go about looking for a new car the same way he had in the past: Shop around, take a couple of test drives, pick his favorite, and negotiate the lowest price. Then he actually went to a few dealerships.

"Even if you see cars on the lots, they're not really there," Groom says. Dealers are parking cars they can't sell, vehicles shipped from the factory without critical microchips, to make it look like there's inventory. Realizing those cars were just for show "was a kick in the pants," Groom says. "We weren't going to be able to go to a dealership and get what we wanted." He couldn't even find anyone willing to let him take a test drive. Out of desperation, he bought a 2022 Hyundai Tucson at sticker price without even sitting in one, simply because it was about to arrive at the dealership in two weeks and he needed a car.

The current lack of new-car inventory may be terrible for a whole host of people—sales staff who depend on commissions, auto workers facing temporary layoffs, suppliers dealing with manufacturers' temporary shutdowns, and, of course, customers—but it sure isn't terrible for one group: dealers. Despite having hardly anything to sell, car dealers raked in $42 million through July, according to the National Automobile Dealers Association, up from $36.7 million through July 2019, before the pandemic.

"Not too bad for car dealers is one way to put it. Fantastic for car dealers is another," says Dan Hearsch, managing partner for automotive and industrial practices at Alix Partners. Dealers are benefiting in two ways: They can hike up the price on new cars, often selling them without a test drive to people willing to pay sticker price or more, and they're also getting a boost from used-car prices. It's such a sweet high for dealers, Hearsch says, that it will be difficult for them to readjust when inventory returns to normal levels, whenever that may be. This summer, in a second-quarter earnings call, Ford CEO Jim Farley said his company is committed to moving more toward an order-based system and keeping actual inventories lower than in the past. "I know we are wasting money on incentives," he said.

More than a decade ago, when the heads of the Big Three automakers sat in front of Congress pleading for bailout money to stay afloat, this economic scenario would have seemed like a fever dream. Back then, U.S. automakers were prisoners of their own success. As they grew over the years, they added workers, gave them amazing healthcare plans, built new manufacturing plants, and opened dealerships across the country. That worked when sales were hot, but as soon as the economy cooled, the industry had to contort itself to pay for all its obligations. Automakers would often resort to generous rebates and incentive programs to keep things running smoothly. And that worked for a while, too, until it all came crashing down in 2008. Eventually, domestic and international manufacturers had to rent parking lots outside the Detroit airport and near ports in Los Angeles to hold the excess cars they'd built for customers who weren't showing up.

That economic situation has flipped today. Recently, Jeremy Beaver, president of Del Grande Dealer Group in San Jose, California, was examining a spreadsheet tracking inventory in the company, which owns 15 dealerships and normally has about 4000 cars in stock. "I'm looking at it right now, and it's crazy," Beaver says. "We have 600 new cars. Cars come in, and they pretty much leave immediately because people have already purchased them."

And yes, Beaver says being on the happy side of the supply-and-demand tug of war certainly has its perks. But ultimately, the dealership group doesn't want its customers to feel like they are being gouged. "Consumers shouldn't have to pay the highest price available just because there is no inventory," he says. He hopes this period is the beginning of an industry transition that makes car buying a little more like other retail experiences, with a more modern approach that focuses on guest experience and is made a heck of a lot easier with technology.

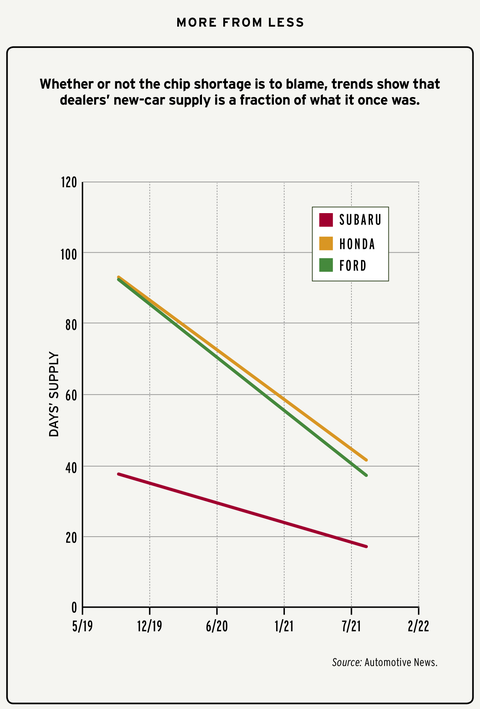

It's easy to blame the car inventory crunch on the microchip shortage, but Hearsch says it's more appropriate to cite generic "supply-chain disruption" at this point. Even if the microchip shortage clears up by the end of the year—and there's no guarantee it will—Hearsch says other kinks in the chain will prevent manufacturers from resuming full-speed production for quite a while. There's a labor shortage in plants and at the ports where import cars are unboxed, lingering COVID issues, and political upheaval in countries such as Malaysia where some parts are made.

And even if automakers could ramp up production and start making cars faster than ever, it will be a long time before dealer lots start filling up. Newly produced cars will first fill current customer orders, then orders from car-rental companies and corporate-fleet customers, and finally excess cars will head to dealers to start evening out the supply-and-demand imbalance. That will "absolutely" take until the end of 2022 if no more disruptions occur, Hearsch says, and until 2023 if things remain rocky.

So, get comfortable buying a car without test-driving it. Colby Buswell, a gym owner from Pinckney, Michigan, ordered a Jeep Wrangler 4xe without even sitting in one. Motivated to get better fuel economy than what his current Wrangler affords him, Buswell started looking for Jeep's plug-in hybrid online but couldn't find one. "I would have had to have gone 750 miles to find one on a lot to test-drive," Buswell says. "That made it a little less fun." There was no negotiating on price, although he was able to haggle down the interest rate a little bit, and now he waits the promised eight to 12 weeks for his new Jeep to arrive. "I'm not in a rush," he says. "I can wait."

Hearsch predicts that those consumers who can wait will be rewarded in the future. American buyers who order ahead will be the ones who can get incentives and rebates, while people who need cars immediately will have to deal with what's on the lot and pay sticker price. Eventually, the situation will calm, he promised. "At some point the cyclical nature of the industry will kick in, and demand will drop, and so will prices," he says. "But it's going to take a long time to dig out from the pent-up demand that we currently have."

"auto" - Google News

October 04, 2021 at 12:01AM

https://ift.tt/3isZsSy

Scarcity Tactics: Low on Inventory, Auto Dealers Cash In on Higher Prices - Car and Driver

"auto" - Google News

https://ift.tt/2Xb9Q5a

https://ift.tt/2SvsFPt

Bagikan Berita Ini

0 Response to "Scarcity Tactics: Low on Inventory, Auto Dealers Cash In on Higher Prices - Car and Driver"

Post a Comment