Li Auto (NASDAQ: LI) stock closed out Monday's trading with substantial gains. The Chinese electric vehicle (EV) company's share price closed out the daily session up 6.7%, according to data from S&P Global Market Intelligence.

Li Auto published vehicle delivery results for June before U.S. markets opened today. Better-than-expected performance helped power big gains for the company's stock.

Li Auto's delivery data points to demand recovery

Li Auto delivered 47,774 vehicles in June. The performance represented a nearly 47% year-over-year increase compared to its deliveries in June 2023. With June deliveries now tallied, the company delivered 108,581 vehicles in this year's second quarter -- up 25.5% on an annual basis. On the heels of demand headwinds in 2022 and 2023, Li now appears to be seeing some recovery trends.

What comes next for Li Auto stock

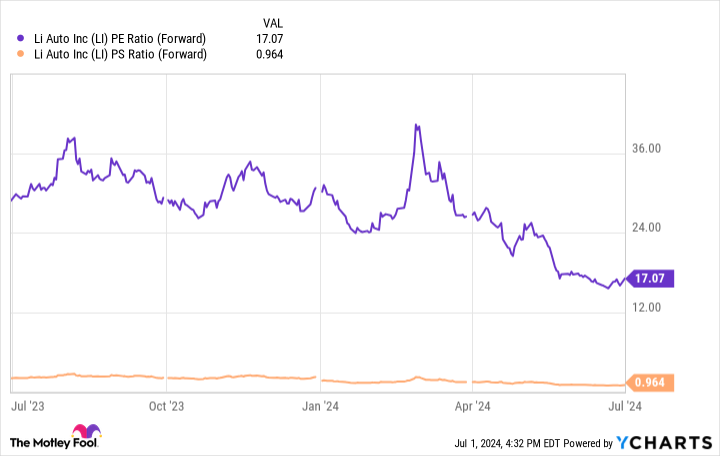

Even with today's gains, Li Auto stock is still down roughly 49% across this year's trading. The company is now valued roughly in line with this year's expected sales, and it trades at approximately 17 times this year's expected adjusted earnings.

Given this year's delivery trends, it's possible that Li stock is actually quite cheaply valued at today's prices. On the other hand, investors have to keep macroeconomic and geopolitical risk factors in mind with the stock. The Chinese EV industry has benefited from continued stimulus this year, but the country's overall economic condition continues to look shaky.

Further complicating matters, there's a fair chance that political relations between China and the U.S. could continue to deteriorate in the near future. If so, Chinese stocks that trade on U.S. exchanges could face outsized headwinds. So while Li Auto may look attractively valued in light of recent business momentum, the stock is riskier than its reasonable price-to-earnings and price-to-sales ratios would imply.

Should you invest $1,000 in Li Auto right now?

Before you buy stock in Li Auto, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Li Auto wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Li Auto Stock Surged Today was originally published by The Motley Fool

"auto" - Google News

July 02, 2024 at 04:20AM

https://ift.tt/e1wZcCQ

Why Li Auto Stock Surged Today - Yahoo Finance

"auto" - Google News

https://ift.tt/24mip7k

https://ift.tt/aVgdtnY

Bagikan Berita Ini

0 Response to "Why Li Auto Stock Surged Today - Yahoo Finance"

Post a Comment