Social distancing has been a boon for the use of photo estimates after auto collisions.

CCC Information Services said that the share of claims processed through its Quick Estimate product increased 125 percent from January to April.

“Based on our data and the conversations we’re having with customers, we expect that this point in time will mark the true digital revolution in claims, led by photo estimating and closely followed AI-powered estimating,” said CCC spokeswoman Michelle Hellyar.

The company did not disclose the starting and ending numbers, but it did say that Photo Estimate reached a milestone last month when the number of estimates produced surpassed 3 million since tracking began in 2018. Several data points show that usage — which has been climbing steadily ever since the technology was introduced — surged during coronavirus shutdowns this year. From February to May:

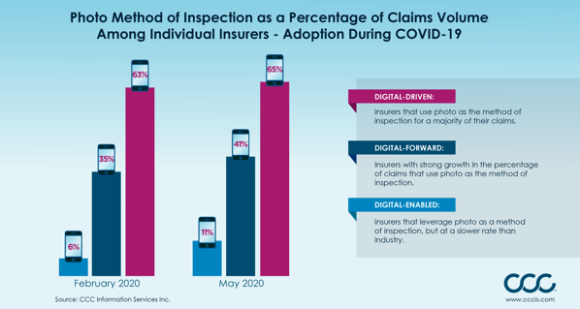

- The share of “digital-driven” carriers that used photos to inspect the majority of their claims climbed from 63 percent to 65 percent.

- The share of “digital-forward” carriers that used photos for 21 to 50 percent of claims climbed from 35 to 41 percent.

- The share of “digital-enabled” carriers carriers that used photos for 20 percent or less of claims climbed from 6 percent to 11 percent.

“CCC works with 350 carriers, and 19 of the top 20, so its view is comprehensive and reflective of what’s happening in the market,” Hellyar said.

CCC does not have a monopoly over photo-estimating technology, but the wide use of its software by auto insurers allows in to glean data even if its own product isn’t used, Jason Verden, senior vice president of production for CCC, explained in a telephone interview.

Verden said carriers that use another photo-estimating app may still enter those photos into CCC’s system to produce an estimate. Even carriers that use another product for taking photos and producing estimates will likely enter that data into CCC’s “total loss care” system because the software is used to track claims data and schedule collision repairs.

The auto collision repair industry has critical of photo estimates because it can lead to low-ball settlements based on only damages that can be seen from the outside. Often a more thorough inspection will reveal major damage that was missed, they say. When cars are taken to the shop, often a supplemental report is needed because more damage is found.

Verden, however, said CCC’s data shows that roughly 40 percent of initial estimates require a supplement whether photo-estimating technology was used or not. He said when the technology was in its infancy, more supplemental reports may have been needed, but improvements have been made — including the use of artificial intelligence.

What’s more, Verden said supplemental reports are often needed because of the sophisticated technology installed in late-model cars.

Verden said 84 percent of consumers who are asked to use CCC’s photo-estimating app do so. He said he believes that the shutdown orders in response to the coronavirus pandemic have eased a generational divide. Older motorists once uncomfortable with video technology are now adept at video conferencing, if only to stay in touch with friends and family, he said.

Was this article valuable?

Here are more articles you may enjoy.

"auto" - Google News

June 05, 2020 at 12:00PM

https://ift.tt/2Xzzv9F

Share of Auto Claims Using Photo Estimates Doubles During the Pandemic - Claims Journal

"auto" - Google News

https://ift.tt/2Xb9Q5a

https://ift.tt/2SvsFPt

Bagikan Berita Ini

0 Response to "Share of Auto Claims Using Photo Estimates Doubles During the Pandemic - Claims Journal"

Post a Comment