Company Overview

Zacks Rank #5 (Strong Sell) stock Li Auto Inc (LI) is an innovator and leader in China’s emerging electric vehicle (EV) market. Li Auto is a pioneer in the Chinese EV market, particularly regarding extended-range electric vehicles, sport utility vehicles (SUVs), and “smart EVs.” Though Li Auto offers a premium product, it has a premium price tag. The Mega multi-purpose vehicle, the company’s first fully electric model, comes with a sticker price of nearly $80,000. Though it was once considered the “Chinese Tesla (TSLA),” other Chinese EV makers have taken off while Li’s fully electric model fell short of Wall Street’s delivery expectations by more than 50%.

Biden Hikes Tariffs on Chinese EVs

Until recently, former U.S. President Donald Trump was thought by investors as being a bigger stickler on China than current president Joe Biden. On both sides of the political aisle, U.S. politicians, auto manufacturers, and business people are growing concerned about China’s dominance in the EV market. Recently, the Biden administration shocked Wall Street and made headlines by quadrupling tariffs on Chinese EV imports to 100% while also taking aim at other EV-related products, such as lithium-ion batteries. Though Li Auto does not currently sell cars in the United States, investors have been hoping to eventually expand internationally. However, the dramatic EV hikes likely ended Li’s chances of accomplishing expansion any time soon.

Domestic Competition is Fierce in China

With international expansion unlikely, prospective Li Auto investors should evaluate the Chinese EV market. Elon Musk, the “Godfather” of the electric car and the world’s richest man, knows a thing or two about electric cars. In a recent talk, Musk called Chinese EV manufacturers “extremely good.” A great example of a Chinese EV maker firing on all cylinders is Warren Buffett–backed BYD Auto. Unfortunately for Li Auto, BYD’s cheapest model starts at a bargain basement price of $9,700, which should make Li’s expensive models a tough buy in the struggling Chinese economy. Meanwhile, Li Auto faces fierce competition from Tesla (who has cut prices dramatically in China) and other Chinese EV makers like Nio (NIO).

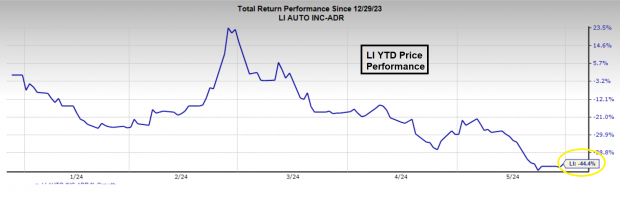

Relative Weakness

LI is a laggard, is down nearly 40% year-to-date, and is stuck below its moving averages.

Image Source: Zacks Investment Research

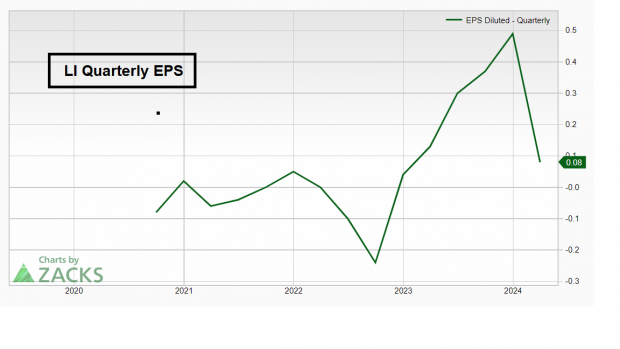

Eps Falling

Last quarter, EPS plunged 68% year-over-year, illustrating that the company’s fundamentals mirror the poor price action.

Image Source: Zacks Investment Research

Bottom Line

Deteriorating fundamentals, relative weakness, and a cutthroat Chinese EV market spell danger for Li Auto shareholders.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Tesla, Inc. (TSLA) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

"auto" - Google News

May 31, 2024 at 03:00PM

https://ift.tt/rqoN2fs

Bear of the Day: Li Auto (LI) - Nasdaq

"auto" - Google News

https://ift.tt/zfyYhla

https://ift.tt/qXabJAW

Bagikan Berita Ini

0 Response to "Bear of the Day: Li Auto (LI) - Nasdaq"

Post a Comment