CarMax (KMX) stock is dropping today, despite a better-than-expected fiscal third-quarter report. The auto retailer announced a revenue beat, alongside earnings per share of $1.42, which is higher than the anticipated $1.14. However, comparable used-vehicle sales dropped to 0.8%, and KMX is down 7.6% at $92.87 at last check.

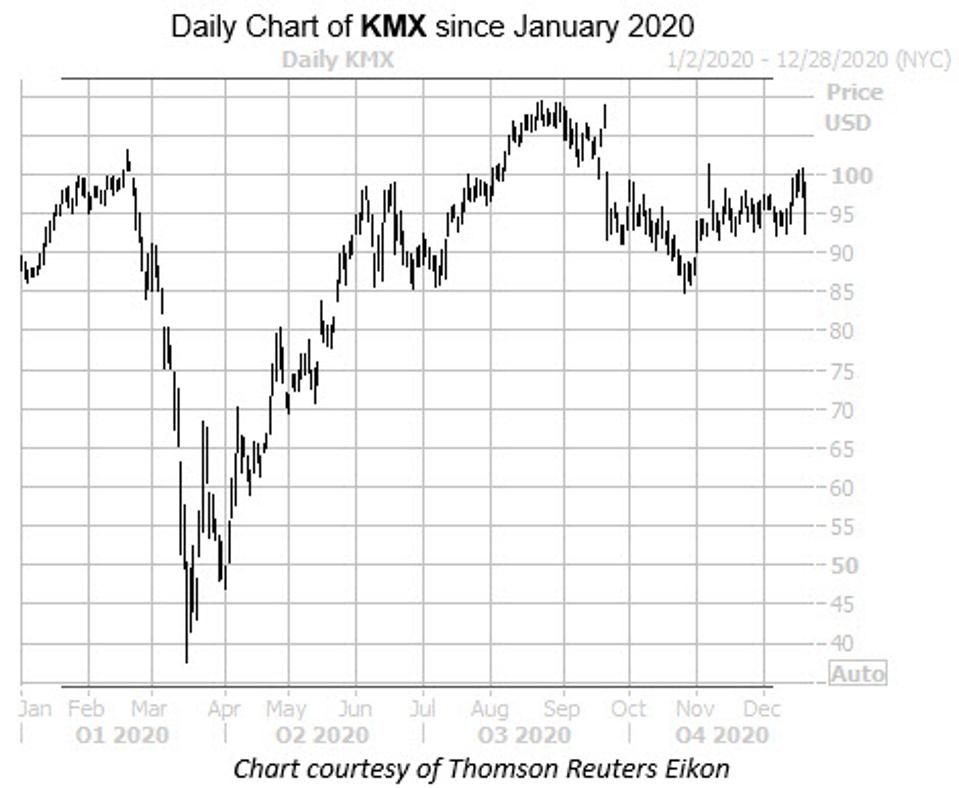

On the charts, CarMax stock yesterday closed above $100 level, a region of pressure since its September bear gap. Now, today’s slide has the shares nearing the $92 level, which has caught several pullbacks since early November. Year-to-date, the equity still is up 6.4%.

Thomson Reuters Eikon

With earnings in the rearview, the options pits are seeing a surge in activity. Already today, 12,000 calls and 9,104 puts have crossed the tape, with overall volume at nine times what’s typically seen at this point and pacing for the top percentile of its annual range. The weekly 12/24 93.50-strike put is the most popular, followed by the January 2021 93-strike put, with new positions being opened at the latter.

Meanwhile, short interest is creeping higher, and the 9.47 million shares sold short account for 5.8% of the stock’s available float. In other words, it would take over six days to buy back these bearish bets at KMX’s average pace of trading, signaling plenty of pent-up buying power that could act as a tailwind moving forward.

Check us out on Twitter @Schaeffers

"auto" - Google News

December 23, 2020 at 12:58AM

https://ift.tt/2WDaj0L

Auto Retailer Drives Lower After Q3 Report - Forbes

"auto" - Google News

https://ift.tt/2Xb9Q5a

https://ift.tt/2SvsFPt

Bagikan Berita Ini

0 Response to "Auto Retailer Drives Lower After Q3 Report - Forbes"

Post a Comment