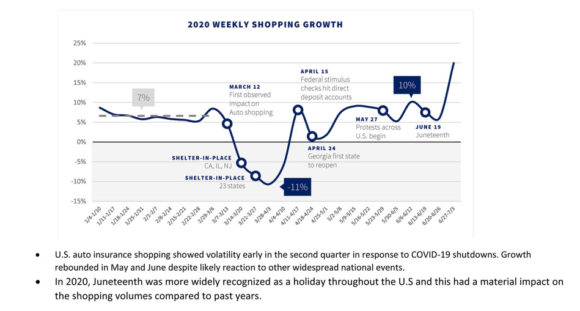

Auto insurance shopping and new business growth rebounded in May and June after a drop in late March and early April due to COVID-19 shutdowns, civil unrest and other events. However, there was little impact on the annual shopping rate, which remained strong for both the first and second quarters, according to the LexisNexis Risk Solutions latest Insurance Demand Meter.

The meter reports quarterly U.S. auto insurance shopping activity data from all outlets.

Among the meter’s findings for the second quarter:

- Overall growth: Although there was a +0.7% increase in the auto insurance shopping quarterly growth rate in Q2 2020, it was still 80% below the 5-year average. New business growth dipped slightly to -1.9% for the quarter, and was seven times lower than the prior year.

- Trends by age group: The 66+ age demographic shopped at the highest rate with five weeks during the quarter topping 20% growth, while the under 35 age groups returned to their anticipated pre-pandemic growth rates hovering around 5% growth.

- Trends by shopping channels: Insurance carriers that use exclusive agents fared the best during the COVID-19 shutdown and have subsequently seen higher growth rates than independent agents or direct channels, ending the quarter at 20% growth year-over-year.

- Trends for new business: New business volume fell to -14% in April, a low that pulled the overall growth rate for the quarter down to -2%. Similar to shopping growth, new business volumes rebounded in May and June to just above 2019 levels and ultimately reached 8% growth by the end of the quarter.

Source: LexisNexis Risk Solutions

Early Q3 Trends

Early Q3 numbers show both shopping and new business volumes are tracking to pre-COVID-19 levels, and market conditions are developing to potentially spur increased shopping growth rates.

“Cancellation moratoria imposed by carriers at the height of the COVID crisis will be expiring, state governments are reopening and issuing more driver’s licenses, and carriers are starting to file for rate decreases,” said Tanner Sheehan, associate vice president of auto insurance at LexisNexis Risk Solutions. “These are all signs that shopping has strong potential to pick up as the quarter progresses.”

Was this article valuable?

Here are more articles you may enjoy.

"auto" - Google News

August 18, 2020 at 12:05PM

https://ift.tt/2CAczzl

Auto Insurance Shopping Rebounds After Dropping During Spring - Insurance Journal

"auto" - Google News

https://ift.tt/2Xb9Q5a

https://ift.tt/2SvsFPt

Bagikan Berita Ini

0 Response to "Auto Insurance Shopping Rebounds After Dropping During Spring - Insurance Journal"

Post a Comment