Auto insurance claims decreased about 30% YOY in mid-year 2020 for Allstate, Geico and Progressive. (Photo: iMoved Studio/Shutterstock)

Auto insurance claims decreased about 30% YOY in mid-year 2020 for Allstate, Geico and Progressive. (Photo: iMoved Studio/Shutterstock)New research from Fitch Ratings shows the positive effects reduced driving in response to COVID-19 stay-at-home and social distancing measures has had on auto insurers’ underwriting profits.

The auto insurance segment experienced a record reduction in claims frequency during the first half of 2020, according to Fitch. Fewer auto claims have provided some relief by offsetting insurers’ increasing pandemic-related losses in other business lines, such as workers’ comp or business interruption.

Fitch warns, however, that the high-performance in the auto insurance segment is not sustainable in the long-term. More drivers are hitting the road, and regulatory and competitive pressures prevent insurers from increasing rates when losses return to normal. “While the timing remains uncertain, frequency of claims will eventually move toward traditional levels, and loss severity moves perennially upward for auto insurance,” said Fitch in a release.

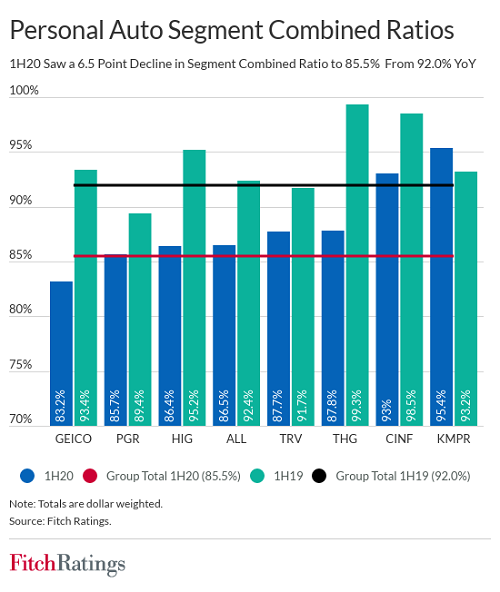

Chart 1: Personal auto results for eight publicly traded insurers. (Fitch Ratings)

Chart 1: Personal auto results for eight publicly traded insurers. (Fitch Ratings)Data from Allstate, Geico, and Progressive indicate that claims frequency decreased by approximately 30% at mid-year 2020 for physical damage and bodily injury claims (Chart 1). In contrast, loss severity increased by about 10% or more for the same coverages.

Chart 2. Claims frequency for eight publically traded insurers. (Fitch Ratings)

Chart 2. Claims frequency for eight publically traded insurers. (Fitch Ratings)Fitch estimates that auto insurers refunded $12 billion to auto insurance policyholders since April 2020, when widespread shutdowns led to an unprecedented driving slump. As such, it is not surprising that net written premiums declined 2% in first-half 2020 compared to the same period in 2019 (Chart 2).

“The claims benefits from frequency reductions significantly outweigh the value of any premium reductions,” said Fitch.

Related:

"auto" - Google News

August 25, 2020 at 11:00AM

https://ift.tt/3jb9wNF

Fitch: First-half 2020 saw record drop in auto claims - PropertyCasualty360

"auto" - Google News

https://ift.tt/2Xb9Q5a

https://ift.tt/2SvsFPt

Bagikan Berita Ini

0 Response to "Fitch: First-half 2020 saw record drop in auto claims - PropertyCasualty360"

Post a Comment