The good news for the US auto industry is that the chip shortage is mostly over, though we expect that some supply chain hiccups may occur from time to time.

Automakers can finally increase production, which should result in more inventory but also more discounting. Higher discounts may sound alarm bells for some investors, but recent incentive levels have been extremely low, so we think the industry has room to offer more discounts without destroying profitability. We also think more discounting is needed to give potential customers a carrot to help mitigate the impact of higher interest rates than before the pandemic.

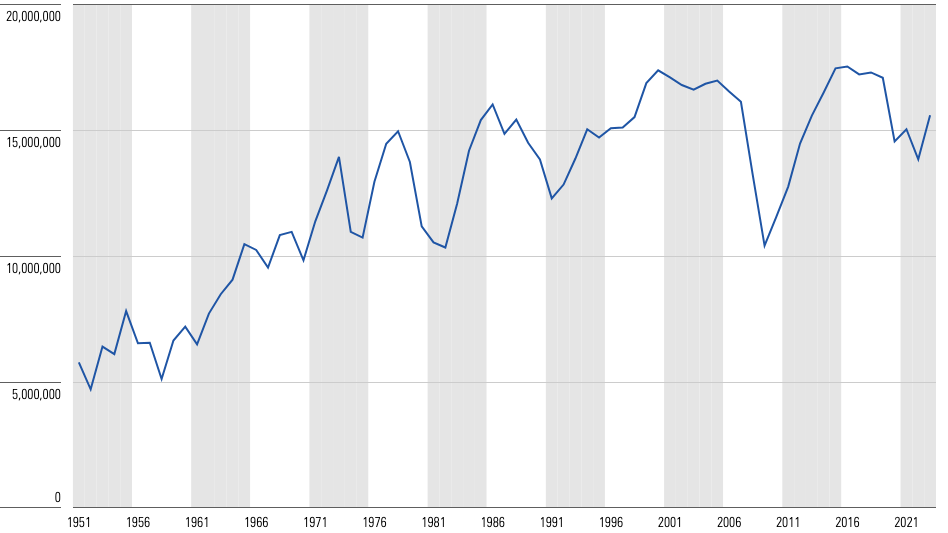

We expect 2024 US light-vehicle sales to increase by about 2% from 2023. We still see the industry as not fully recovered from the pandemic and chip shortage; barring a recession, we see upside potential to this forecast range because it’s still around recessionary levels based on our historical per capita sales analysis.

Even if the United States has a recession this year, we think sales would not suffer as severely as they normally would because, in our view, US auto sales have been in recession since the spring of 2020. Interest rates are a concern; however, we think the Federal Reserve is likely to lower rates this year—and some certainty around rate levels can only be good news for consumers.

Our US Light-Vehicle Sales Forecast

We forecast US light-vehicle sales between 15.6 million and 15.8 million units in 2024.

We see more uncertainty for 2024 than in a typical year as the chip shortage lingers, although it has dramatically improved from a year ago. Interest rates are still a problem, though more for used vehicles than new, but they should decline this year. Inflation remains, as do concerns about a potential US recession and the impact of the presidential election.

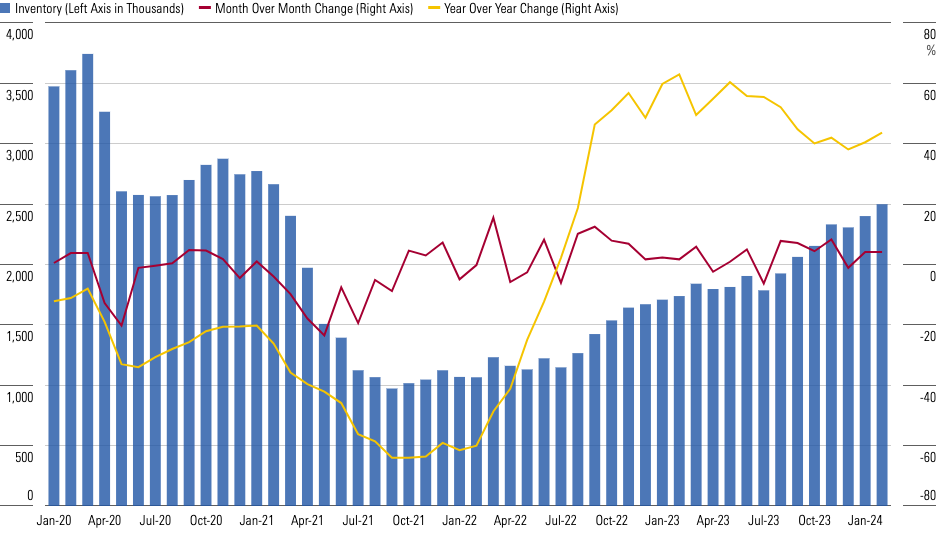

Inventory’s recovery from its September 2021 low is progressing well but is still far below where it should be. At the end of February, levels were at 2.5 million—their highest for any month since they stood at 2.7 million in February 2021.

Vehicle scarcity and now high interest rates are keeping some consumers out of the market, so we still believe that sales can actually rise in a recession. We don’t normally say that, but US auto sales have already been at severe recessionary levels at times across 2020 and 2021, and recent levels are indicative of a mild recession absent current supply chain issues. Normally, just before a recession, incentives as a percentage of average transaction price are high, as are sales, but none of that is happening now.

We try to be reasonable but a bit conservative in our US forecast. This year holds uncertainty owing to US macroeconomic headwinds from a variety of sources, like inflation and the runup to and aftermath of the presidential election in November.

We stress that uncertainty can also mean upside surprises; sales could come roaring back in the case of rate fears subsiding or a positive geopolitical event such as the war in Ukraine ending. The year is off to a modest start, with Wards Intelligence placing the January seasonally adjusted annualized selling rate at 14.9 million, down slightly from 15.1 million in January 2023. February’s seasonally adjusted annual rate of 15.81 million showed good improvement from February 2023′s 14.87 million, so sales are moving in the right direction with 6% year-over-year growth.

GM No Longer a Favorite, but It Remains Cheap

We believe General Motors GM stock is quite undervalued, but we think that a more militant United Auto Workers union adds to the myriad risks associated with investing in an already high-uncertainty stock that operates in a capital-intensive, highly cyclical, and viciously competitive industry.

Still, there’s much to like about GM’s stock.

We think the bold move of a $10 billion accelerated share repurchase (which was announced in November) shows management’s high conviction that the stock price is too low.

We also see this move as misunderstood by critics. GM has been investing in electric vehicles for years, so a lot of the heavy lifting on EV model development and Ultium battery technology is already spent or budgeted for along with the accelerated share repurchase. We believe that GM has the capital to transform itself from just an automaker into a data service provider and EV and autonomous vehicle manufacturer (GM plans to resume its Cruise robotaxi service soon).

We like GM management’s aggressive late-2023 moves to boost the stock and show the market its confidence in free-cash-flow-generating ability with labor peace secured through April 30, 2028, when the 2023 UAW deal expires.

2028 UAW Talks Remain a Concern

The 2023 UAW talks were the most dramatic in decades, and we expect another strike in 2028 at all three firms (GM, Ford F, and Stellantis STLA).

Now that the UAW has achieved nearly complete wage parity for members, it will turn its focus to eliminating what it sees as the biggest remaining tier difference: pensions and retiree healthcare.

We don’t know the specifics of what the UAW wants in pension reform yet, but we think a 2028 strike focused on these specific issues could make the 2023 strike look tame.

We see resuming both pension and healthcare benefits as a liability of many tens of billions of dollars at each automaker, and we don’t think management teams are willing to do so at the risk of destroying their competitive advantages against foreign automakers.

The uncertainty of potential increases to retirement funding and the 2028 strike risk make GM less of a high-conviction idea for us, though we believe it’s still cheap for those willing to be patient.

"auto" - Google News

March 07, 2024 at 04:56AM

https://ift.tt/kmXKZIE

The Chip Shortage Is Mostly Over, but the Auto Industry Hasn't Fully Recovered - Morningstar

"auto" - Google News

https://ift.tt/DecOQyk

https://ift.tt/fUrGEsh

Bagikan Berita Ini

0 Response to "The Chip Shortage Is Mostly Over, but the Auto Industry Hasn't Fully Recovered - Morningstar"

Post a Comment