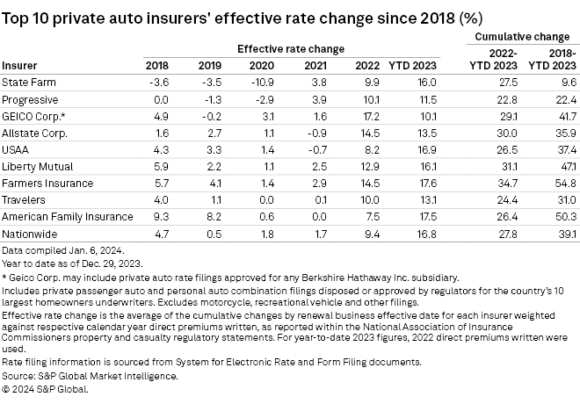

According to S&P Global Market Intelligence’s RateWatch, Farmers Insurance instituted double-digit rate increases in 43 states in 2023 for a weighted average rate increase of 17.6%—and its private-auto insurance peers in the U.S. did the same.

All 10 of the top auto insurers in the U.S. raised rates double digits in 2023, with all but two—GEICO and Allstate—ending the year with higher rate increases than the prior year. The duo were among insurers that raised auto rates the most in 2022.

American Family was very close behind Farmers when it came to rate increases in 2023, with 17.5%. USAA hiked auto rate 16.9%, with Nationwide, Liberty Mutual and State Farm also increasing rates at or above 16%, according to S&P GMI.

Related: Auto Insurance Costs Soar by 20% in the US

U.S. auto insurers had a tough time in 2023 as rate increases failed to keep up with jumps in claim frequency and severity. A previous report from S&P GMI observed that increases in severe auto crashes have resulted in a rise in litigated claims, and severe weather and a surge in vehicle thefts resulted in higher losses in comprehensive coverage.

2023 was the second year in a row that nationwide rate changes were above an average of 10%, pushed by increases above that mark in 43 states and the District of Columbia. The nationwide rate hike for 2023 averaged 14% after an average increase of 11.4% for the U.S. in 2022.

S&P GMI found that Nevada had the largest rate increase in 2023, at 28.3%, followed by Minnesota and Washington at nearly 20%. Hawaii, North Carolina, and Colorado each saw increases of less than 5% for the year.

Was this article valuable?

Here are more articles you may enjoy.

"auto" - Google News

January 18, 2024 at 11:19PM

https://ift.tt/zFepqru

10 Largest Auto Insurers Each Raised Rates by Double Digits in 2023 - Insurance Journal

"auto" - Google News

https://ift.tt/ctsxO6k

https://ift.tt/63LEAdZ

Bagikan Berita Ini

0 Response to "10 Largest Auto Insurers Each Raised Rates by Double Digits in 2023 - Insurance Journal"

Post a Comment