Rising auto insurance premiums have been a notable driver of inflation in the past several months. In April, motor vehicle insurance jumped 22.6% from a year earlier, the largest increase since 1979, Bank of America Securities Economist Stephen Juneau pointed out in a recent note.

"This has been an increasing driver of the stickiness of core CPI inflation, which remains elevated at 3.6% y/y in April," he wrote. While the higher cost of motor vehicle insurance isn't a recent trend, it has taken a larger role in jacking up CPI core services excluding rent and owners-equivalent rent, also known as supercore services.

Motor vehicle insurance contributed 2.3 percentage points to the 4.9% Y/Y increase in supercore services CPI, while all other components contributed 2.6 ppt.

"The turbocharged increases in motor vehicle insurance premiums are a response to underwriting losses in the industry," Juneau said. The factors leading to those losses include higher vehicle prices (both new and used), increased repair costs for both technology and labor, and a higher number of accidents as driving patterns returned to normal.

Recall that supply chain disruptions caused by COVID-19 led to surging vehicle prices even as Americans drove less due to remote work and the halt of most leisure travel during the worst of the pandemic.

The good news is that motor vehicle insurance rate growth appear poised to slow. "There are signs that many insurers are getting back to profitability," Juneau said. "Additionally, vehicle prices have retraced some of their previous increases and wage growth in the industry has cooled. This does not mean that your premium will fall, but we think the rate of increase should slow."

The next major data point that the Federal Reserve will be looking at to gauge inflation is the personal consumption expenditure figures in the Personal Income and Outlays report due out on Friday. In that indicator, motor vehicle insurance increases have been modest, partly explaining the gap between the supercore services inflation numbers in CPI vs. PCE inflation — +4.8% in March for CPI vs. +3.5% for PCE. Both, though, are markedly higher than the prepandemic rate of 2.0%.

"We think further improvement in this aggregate is one key for the Fed to become more confident in the disinflationary process and start its cutting cycle. Until then, we expect the Fed to keep rates in park," BofA's Juneau wrote.

Core PCE, which excludes the volatile food and energy categories, is expected to rise 2.8% Y/Y in April, the same increase as in March, according to TD Economics.

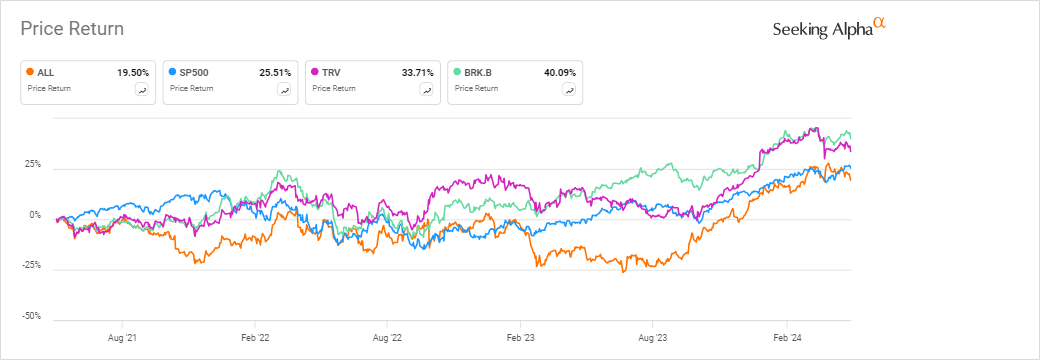

With the rising insurance premiums, P&C insurer stocks have also been climbing. In the past year, Allstate (NYSE:ALL) drove up 41% and Geico parent Berkshire Hathaway (NYSE:BRK.B) (NYSE:BRK.A) gained 25%, both exceeding the S&P 500's 27% increase during the same period. Travelers (NYSE:TRV), meanwhile, rose 18%.

In the P&C insurance sector, the SA Stock Screener rates seven stocks at a Strong Buy, with Allstate (ALL) topping the list.

More on Allstate, Berkshire Hathaway, etc.

"auto" - Google News

May 27, 2024 at 03:17AM

https://ift.tt/MVZ1qct

Auto insurance inflation set to tap on the brakes, BofA economist says (NYSE:TRV) - Seeking Alpha

"auto" - Google News

https://ift.tt/lcuvf6w

https://ift.tt/Xi7ybHu

Bagikan Berita Ini

0 Response to "Auto insurance inflation set to tap on the brakes, BofA economist says (NYSE:TRV) - Seeking Alpha"

Post a Comment