China-based electric vehicle (EV) makers XPeng XPEV and Li Auto LI recently unveiled first-quarter 2024 results. While shares of XPEV popped roughly 6% after the quarterly results yesterday, LI stock fell for the second consecutive day after it announced results on May 20.

Investor optimism for XPeng was driven by improved first-quarter results, a strong second-quarter outlook and advancements in self-driving technology.The company announced plans to achieve a Level 4 autonomous driving experience in China by 2025. Additionally, it is set to launch its mass-market MONA-branded EV next month, priced under 200,000 yuan ($27,630), which will feature Level 2 autonomous driving capabilities. This will be the first MONA car launched since XPeng took over the project from ride-hailing giant Didi last year. XPEV currently carries a Zacks Rank #3 (Hold).

Conversely, Li Auto's stock suffered due to a decline in net profits and the deferment of its electric SUV models to next year. The company cited hurdles such as insufficient fast-charging infrastructure. Previously, Li Auto had intended to introduce three electric SUVs this year. LI currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Look at the Q1 Key Metrics

Deliveries: XPeng sold 21,821 vehicles (up roughly 20%) in the quarter under review. Li Auto’s deliveries jumped 53% to 80,400 units.

Revenues: XPeng’s revenues totaled $906.9 million, up 62.3% year over year. Revenues from vehicle sales (which constitutes 84.7% of total revenues) totaled $767.9 million, up 58% year over year. Li Auto’s revenues rose 36.4% to $3.6 billion. Vehicle sales (accounting for 94.6% of total revenues) were up 32.3% to $3.4 billion.

Vehicle Margin: For XPeng, the metric improved to 5.5% from negative 2.5% in the first quarter of 2023 and 4.1% in the fourth quarter of 2023, thanks to cost reduction and improved product mix. In contrast, Li Auto's vehicle margin decreased to 19.3% in the first quarter of 2024, down from 19.8% in the first quarter of 2023 and 22.7% in the fourth quarter of 2023, owing to a reduction in the average selling price of vehicles.

Operating Expenses: XPeng’s R&D and SG&A costs rose 4.2% and 0.1%, respectively, on a yearly basis. R&D and SG&A costs for Li Auto increased 64.6% and 81%, respectively, in the first quarter of 2024. Operating expenses, as a percentage of sales, were 41.8% for XPeng and 22.9% for Li Auto.

Earnings: While Li Auto’s net income fell 37% year over year to roughly $82 million in the first quarter of 2024, XPeng’s bottom line improved. Although XPEV incurred a net loss of $190 million, the loss narrowed by 41.4% on a yearly basis.

Q2 Outlook

XPeng expects second-quarter deliveries in the band of 29,000-32,000 units, which implies an uptick of 25-37.9% from the year-ago period. It envisions revenues within RMB 7.5-8.3 billion, implying year-over-year growth of 48.1-63.9%.

Li Auto guided second-quarter deliveries to be between 105,000 and 110,000 units, up 21.3-27.1% year over year. Revenues for the current quarter are projected in the range of RMB 29.9-31.4 billion, calling for an increase of 4.2-9.4% year over year.

Financials

As of Mar 31, XPeng’s cash/cash equivalents amounted to $2 billion and long-term borrowings totaled $752.5 million. At quarter end, Li Auto’s cash and cash equivalents were 11.8 billion. Long-term borrowings were $249 million. While both companies have a low debt pile, LI’s long-term debt-to-capitalization stands at 12.6%, lower than XPEV’s 23%.

Image Source: Zacks Investment Research

EPS & Sales Estimates

The Zacks Consensus Estimate for Li Auto’s 2024 sales implies year-over-year growth of 32%. The estimate for 2024 EPS has moved 47 cents south over the past 30 days to $1.50, indicating a year-over-year decline of 6.9%.

Meanwhile, the consensus mark for XPEV’s bottom line is pegged at a loss of $1.25 per share, which suggests an improvement from a loss of $1.68 per share incurred in 2023. Estimates for 2024 sales imply an increase of 63%.

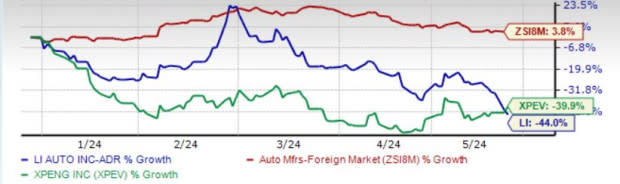

Stock Performance & Valuation

Year to date, shares of XPEV and LI have contracted 40% and 44%, respectively, versus the industry’s growth of 3.8%.

Image Source: Zacks Investment Research

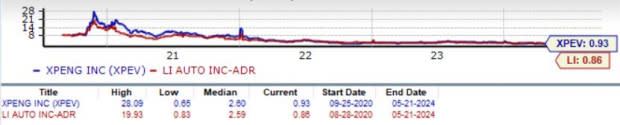

As far as the price/sales valuation ratio is concerned, LI is trading at a forward sales multiple of 0.86, below its median of 2.59 over the last five years but higher than the industry’s 0.68. XPEV also trades at a premium when compared to the industry. Its forward sales multiple is 0.93.

Image Source: Zacks Investment Research

Last Word

While both XPeng and Li Auto face unique challenges and opportunities, XPeng's advancements in autonomous driving and strong second-quarter outlook have positioned it more favorably in the market after its first-quarter earnings. Li Auto’s delays and financial setbacks have dampened investor confidence despite robust delivery growth.

As both companies continue to innovate and expand, their future performance will hinge on addressing current obstacles, such as fierce competition and slower-than-expected EV adoption, while capitalizing on emerging market trends like advancements in autonomous driving, charging infrastructure development and cost-reduction efforts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

"auto" - Google News

May 22, 2024 at 09:37PM

https://ift.tt/lPoD801

How Do Li Auto (LI) & XPeng (XPEV) Stack Up Post Q1 Earnings? - Yahoo Finance

"auto" - Google News

https://ift.tt/ouPyS21

https://ift.tt/9dT6F1q

Bagikan Berita Ini

0 Response to "How Do Li Auto (LI) & XPeng (XPEV) Stack Up Post Q1 Earnings? - Yahoo Finance"

Post a Comment